IRUSA is Far Worse on Zakat Than We Knew

Islamic Relief USA responded to my article on costs. It gets worse.

You are reading a note from the Working Towards Ehsan Newsletter, covering Muslim Non-Profits and Leadership. This is a free service of Islamic Estate Planning Attorney Ahmed Shaikh. Click here to subscribe to this newsletter below:

Earlier in Ramadan I wrote about Islamic Relief USA (IRUSA) obscuring their costs, which, while mostly unknown, were likely significantly higher on zakat than advertised (12.5%) based on discussions with former and current IRUSA staff and a review of their federally filed 990.

Loyal Islamic Relief donors expressed enough concern that Islamic Relief provided a response that confirmed my main points and should be alarming to any zakat donor for reasons that go far beyond my original article. They did this while treating the reader to baffling, self-contradictory prose. I will do my best to break down what is happening.

Zakat is for IRUSA’s Non-Profit Empire Building

I am going to assume something about you if you are an IRUSA donor. You donate zakat to IRUSA because you, as an act of worship and obedience to Allah, want to benefit the poor and needy. You did not necessarily donate to IRUSA because you want it to become an NGO behemoth with double-digit year over year growth so that it can pay larger salaries and bonuses to its senior executives who might otherwise go to the tech sector. It is nice if that happens, but you don’t think that is a legitimate zakat purpose.

In its rebuttal to my article, Islamic Relief opened by citing “the overhead myth”— a 2013 TED talk by Dan Pallotta that has taken a near-scriptural level of authority in the nonprofit sector. The basic idea is that nonprofits should grow because they are the essential good in this world notwithstanding overhead, which is a small-minded way of thinking about things. For example, a small $1 million-dollar-a-year nonprofit that gives 90% to the poor and needy has less inherent worth than a nonprofit that raises $200 million dollars but has an overhead of 50%.

Nonprofits often view themselves as “social enterprises” — getting big is the real value, because how can you make a difference otherwise? This venture capital-like logic has explicitly found a home in zakat giving.

So, when you donate zakat to Islamic Relief, you are doing so much more than just giving to the poor and needy; you are investing in a growth story. This is like investing in a technology company.

Much of Islamic Relief’s defense is predicated on this kind of nonprofit sector thinking. If you are the kind of zakat donor that is really donating zakat to participate in Islamic Relief USA’s growth story, please cancel your subscription to this newsletter. Nothing I have to say about zakat or nonprofits will have any value to you.

Head Fake Zakat Policy

While the FAQ defense is full of leading questions nobody asked, a very good question is if Islamic Relief USA has a zakat policy and if donors can see it.

So, the answer is IRUSA has no zakat policy (which is what I told you earlier this month). IRW has one that IRUSA is generally guided by where it is applicable. The zakat policy at IRW was created by scholars who established what they believed were the limits in the sharia to the exact work IRUSA is fundraising for and is applicable to all Islamic Relief offices. IRUSA does not like the limits given to them by their own scholars, so they make up their own limits, only they will not tell us what those limits are, since they don’t have an alternative policy.

One reason they use weasel words like “where it is applicable” or “generally guided” is that IRUSA is brazenly ignoring the Islamic Relief zakat policy, which by its terms is supposed to apply to all Islamic Relief offices, yet for whatever reason feel comfortable whipping out the policy for donors who ask for one.

Why a Zakat Policy is Important

The zakat that IRUSA collects is not for themselves. Zakat donors entrust it to them so IRUSA can distribute it to the poor and needy (and other zakat categories, though this is what IRUSA emphasizes). They have certain legitimate expenses, and the role of the policy is to explain to donors how they assess costs and describe what they regard as permissible and impermissible uses of funds donors have entrusted them with.

If you violate the terms of the policy, say you take a charge against zakat for advertising on Google or sponsorship of a doctor’s conference when your policy tells you this is not permissible, that is a clear breach of your duties and is morally the equivalent of theft of zakat from the poor and needy, including orphans (consuming the wealth of orphans being one of the 7 major sins, sandwiched right between “murder” and “consuming riba” from a hadith of the Prophet ﷺ.)

Here is something you should know about the IRW Zakat policy, it has a hard cap of 12.5% on “amileena alaiha” (administrators of zakat), but IRUSA has used this number to mislead donors into thinking they can do what they want with the money. The Islamic Relief Zakat policy is crystal clear:

Costs associated with fundraising, marketing, event sponsorship, influencers, generic training and governance costs are not eligible to be charged to 12.5% administration category

IRUSA has few charitable programs of its own and has no international charitable programs at all. IRUSA is primarily focused on fundraising, marketing, and event sponsorship. They have IT, HR, and other hard costs, and then they make grants to IRW, where the real work that is eligible for zakat funds is carried out.

Fun with Words, and Accounting

One question answered is that it is true that the 2019 form 990 has 31% in administrative fees. For my article, I just did some arithmetic from numbers on the 990, which IRUSA did not challenge. I never actually said anything about an “administrative fee.” Such a thing does not exist on the federal 990. Who goes to a charity and asks about “administrative fees” anyway? IRUSA seems to believe we are interested in this thing they made up. Donors are interested in costs and overhead to assess the value from their donations and how much waste may be going on. Those are reasonable things to care about.

The use of the “administrative fee” jargon seems more like it is meant to confuse the reader, by answering a question nobody knew they cared about.

Administrative fee? What, like Goldman Sachs?

IRUSA is treating the 12.5% number as a floor and not a ceiling. They are attributing costs their zakat policy does not permit them to charge against zakat by making it a standard flat fee the sharia somehow allows them to charge, in addition to other expenses. This is how they deploy claptrap like “zakat-specific donations incur a standard administrative fee of 12.5% from IRUSA in adherence with Islamic jurisprudence.” While I am not an Islamic scholar, I am quite confident a “standard administrative fee of 12.5%” is not an actual thing in Islamic jurisprudence. That is not a thing in Islamic Relief’s zakat policy, or form 990. It is just something IRUSA made up and is now “charging” poor people and orphans with junk fees. It sounds official though, like something found on a hedge fund disclosure statement. This might be “social entrepreneurship” that follows the gospel of the “overhead myth”- it is not charity, and it is certainly not zakat.

This is not the only instance of fun with terminology we see from Islamic Relief.

Programmatic and Administrative

The terms “programmatic” and “administrative” is terminology often used to confuse donors. Intuitively it means anything not the actual aid is “administrative.” That is not actually true though. In the 2020 990 for example, IRUSA contributed millions of dollars for salaries, advertising, conference attendance and a wide range of other things you would not think of as delivery of aid as “program service expenses.” IRUSA’s job is mostly to collect and send money to IRW in the UK (where it is subject to more costs).

But there is another wrinkle here. For zakat purposes, we do not actually care about accounting practices are prevalent among US nonprofits or what it takes to get a low “program expense ratio” on Charity Navigator. What matters here is what expenses are appropriate for zakat. The Islamic Relief Zakat policy permits virtually none of this. IRUSA keeps talking about “Islamic Jurisprudence” but is making all this stuff up without any support from scholars, even its own scholars.

IRUSA will throw out numbers on made-up terminology like “administrative fee” but there is really no escaping the numbers they put up on their federal filing from 2020 (look at part IX, not just the front page).

The form 990 from 2020 showed IRUSA delivered $47 million in grants and aid out of a total in expenditures of about $72 million, so about 35% is their costs (however they categorize it), before they grant the money, mostly to IRW the UK, which subjects the funds to more costs. This was a year where they raised $110 million (all numbers rounded). Remember IRUSA keeps funds on their balance sheet. Effectively IRUSA distributes 42% from what they raise. This is everything, not just zakat. Unfortunately, I have not seen a zakat breakdown. It would be nice if IRUSA provided it.

$4.4 Million on Google, $1 Million on Facebook, to Fuel Growth

In the 990 from 2020, IRUSA spent 4.4 million dollars on Google, mostly advertising, but perhaps some on services like email. They also spent a bit under $1 million on Facebook.

While we don’t know how much of this spending was from zakat, IRUSA justifies this kind of advertising as a legitimate zakat expense, because as an administrator of zakat, “Islamic Jurisprudence” permits this. Also, it helps IRUSA grow (remember the “overhead myth” somehow applies to zakat).

Google and Facebook are not permissible zakat beneficiaries. I could not find any scholars who support this kind of gluttonous spending, and you would be hard-pressed to find anyone credible that can do that either. Islamic Relief’s zakat policy prohibits this. It is just such a comically absurd cost to saddle on zakat beneficiaries. Yet this is what they are doing.

But again, the “overhead myth” confronts us. We are thinking too small right? Think of how much good IRUSA could do if they had millions and millions more.

IRUSA has two major problems justifying this. The first is how Pay Per Click (PPC) advertising works, the second is that IRUSA is not actually making a bigger zakat pie, they are mostly cannibalizing zakat from other zakat-collecting organizations.

How PPC Advertising Works

IRUSA buys advertising in an auction market competing with other charities for terms like “pay zakat.” They pay (with zakat), to encourage a person who is already inclined to go online and pay zakat to go to IRUSA.

Say Abdullah goes on Google and clicks on IRUSA’s link but does not give it to IRUSA. IRUSA pays zakat for the privilege of Abdullah’s eyeballs for a few seconds. Ishaq pays zakat to IRUSA from an email solicitation, but he is also paying for Abdullah’s visit to IRUSA’s website, and several others. IRUSA did nothing to “administer” Abdullah’s zakat, since he paid them none. They paid for marketing to Abdullah, but he decided to give it to his local masjid’s zakat distribution committee instead.

For IRUSA, it is a numbers game. They look to get an impressive return on investment by spending massive sums of money, which is great for a growth-focused organization. However, for each individual donor, the percentage of value per dollar that goes to actual zakat recipients drops while IRUSA can score larger and larger numbers to fuel its growth.

Online Zakat Advertising cannibalizes from other Charities and Harmful to Zakat Beneficiaries

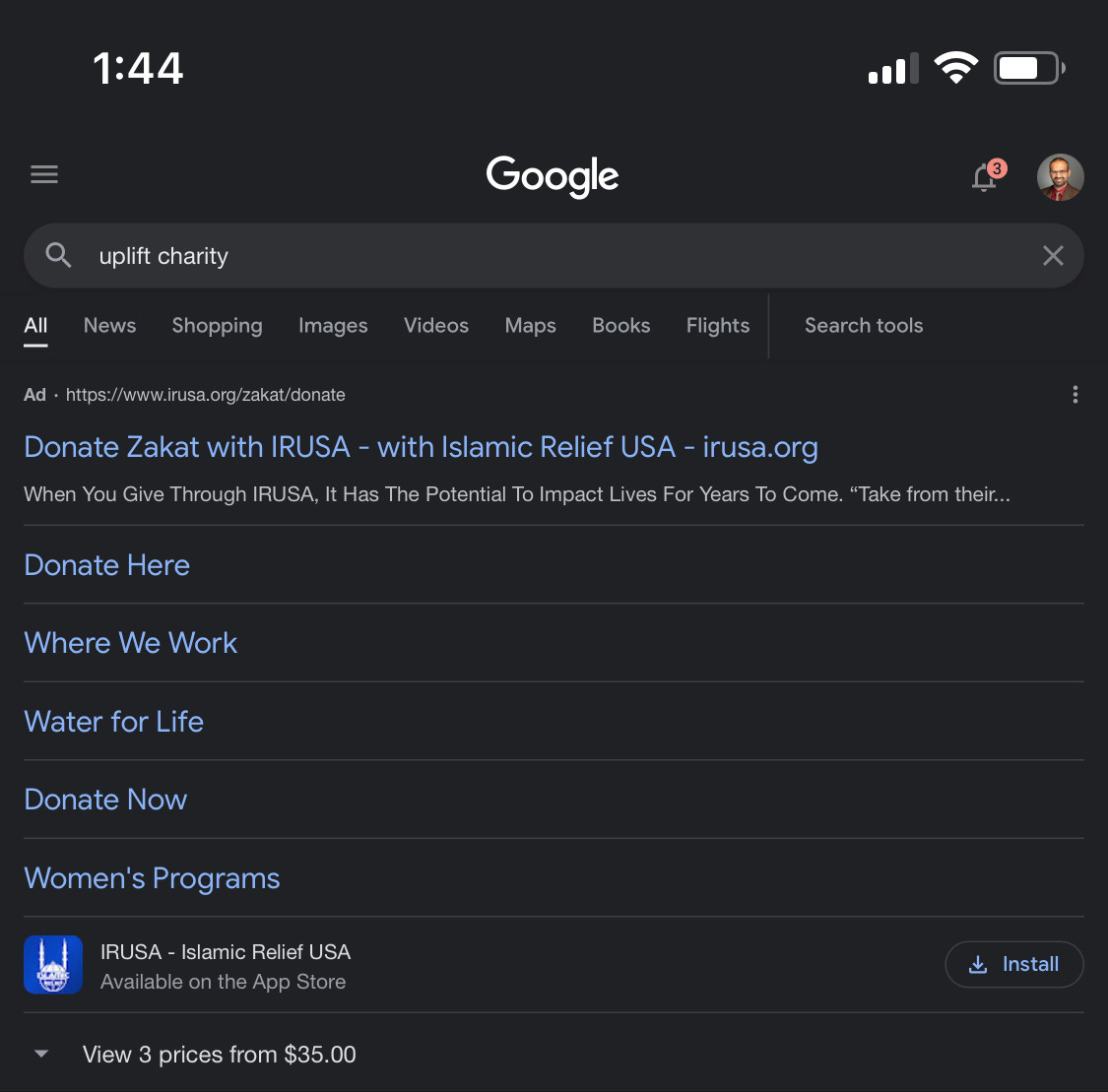

I did a search for “Uplift charity,” a zakat distributor in Southern California that is largely volunteer run and takes no expenses for its local zakat distribution program.

The first search result will often be a large set of links from IRUSA, while the organization I searched for is far down the page. What happened here? IRUSA bigfooted a local charity an internet searcher would have intended to donate to, with the hope to manipulate a potential donor elsewhere into donating to IRUSA’s expense-laden zakat instead, otherwise they would not spend their copious millions of dollars in this kind of practice.

I ran many searches for charities large and small around the country and found this happening repeatedly.

Did they conjure more zakat than donors would have otherwise donated? Unlikely. Muslims pay zakat out of obedience to Allah, and this advertising is hyper-targeted. IRUSA wants market share dominance.

Several Muslim charities play the search advertising game. They are all buying up each other’s names in search results hoping to poach each other’s donors, not to mention other search and targeted marketing projects and experiments, including on YouTube. Muslim charities (like Islamic Relief) are often using zakat funds to lure the same zakat donor. This situation does not benefit donors or zakat beneficiaries. Islamic Relief’s zakat policy prohibits this for sound reasons.

IRUSA will have you believe this is all a valid zakat eligible expense based on something in the Quran or “Islamic Jurisprudence.” They cannot support this claim with anything.

IRUSA, and its collaborators need to Fix This

IRUSA has a massive ecosystem of support, much of it purchased with marketing money, including zakat funds. IRUSA believes marketing is a legitimate zakat purpose though Islamic Relief’s zakat policy is against this. They sponsor Muslim meetings and gatherings large and small, pay honorariums and distribute swag at conferences. We don’t know how much of this is purchased with zakat. We do know IRUSA sees spending zakat on such things as legitimate. It is not.

American Muslims are being conditioned by relentless marketing (much paid by zakat) to think all this rot is okay, that we don’t need to worry about violating the rights of those Allah has ordained as the true and legitimate beneficiaries of Zakat.

The Muslim community, including the most influential people Islamic Relief management and board members care about, should try to persuade IRUSA to clean up its zakat act. Misappropriation of zakat is a grave issue in Islam, as is unjustly taking from the wealth of orphans. This will continue if the Muslim community continues to act like this is not a big deal.

Being an avid Islamic Relief donor for years, when I noticed the salaries of the CEOs in the past couple of years, it just didn't sit well with me. Thank you for taking the time to do the research for us, I will probably cease my donations to Islamic Relief and choose a different avenue for donations, unless they clean up their act. Extremely disappointed that what I was suspecting is actually true to a degree.

Jazak Allahu Khayran for this article.

I see no religiously valid reason to give zakat to IRUSA. The same goals can be accomplished (and even more, as less $ are spent on admin) by donating to Islamic Relief Worldwide (the UK organization).

Interestingly, IRUSA admits as much in its answer to question 8 in its webpage: "https://irusa.org/admin-explained/" Basically, it says the only reason to give to IRUSA as opposed to Islamic Relief Worldwide is that US taxpayers can get a tax deduction.

Now, getting a tax deduction is nice, but that is not the purpose of giving zakat. And we should not be picking zakat recipient simply because we can get nice tax deductions. I'm guessing the best zakat is to give cash to one's poor neighbors. We certainly won't get tax deductions doing that!